4 Success Factors for South African Online Retailers

In this blog post we highlight the key takeaways from a presentation by tech researcher, Arthur Goldstuck, on the results from the largest-ever online retail survey undertaken in South Africa.

The demographics of online retail in South Africa

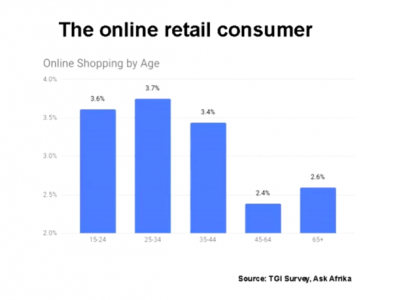

Age: The percentage of South Africans shopping online regularly is very small. The age group with the highest tendency to shop online is 25 to 34, followed by 15 to 24 and then 35 to 44.

What does this mean for you?

Targeting your online retail up to the 35 to 44 age group means that there is a higher likelihood that they will shop online than the older age groups. What is dramatic about these statistics is the extent to which online shopping drops off after 44.

Arthur explains that if you examine the history of the internet and of online retail in South Africa, you realise that anyone aged over 44 was essentially entering the full-time workspace before the internet had become mainstream in South Africa and that seems to be one of the great differentiators for readiness of shopping online and being reticent about it. But there are outliers and there are even those who are 65+ who are very eager online shoppers.

Gender: Females are much more likely to shop online than males.

What does this mean for you?

This is strongly driven by the category of shopping that has the most outlets in South Africa, which is apparel. Arthur says, “it’s a known fact that clothes shopping is done more by women than by men, usually women buying for men as well. But the reality is that most of the apparel stores online have got a strong female orientation in terms of what’s on sale.”

This tells us that there is an online market to be tapped into if your product or services cater to men or other categories that would appeal specifically to women.

Employment Status: There is a clear distinction between people working full time compared to those working part-time or not working, however the great divide between unemployed (student living at home where others are earning and are able to provide credit card details) versus not working (no disposable income) is significant.

What this means for you?

When identifying your target audience, you want to ensure that your 25 to 34 and 35 to 44 age groups are employed, but don’t rule out the 15 to 24 age range because they are unemployed, they may still have access to a disposable income and have a high propensity for shopping online.

From a larger perspective though, if we could increase employment in South Africa it would very quickly increase online retail.

Marital Status: One of the most interesting statistics about South African online shoppers is that the category most likely to shop online are those who are divorced and single.

What this means for you?

While there are many reasons as to why this may be, you want to include targeting divorced and single audiences, based on whether your product or service is applicable to them.

Arthur believes that those who are divorced no longer have someone telling them what to do or how to do it, as with those who are single, while those who are separated are in a volatile stage of life and taking the risk of shopping online is not a consideration. But there could be a variety of reasons behind these trends.

Using this information could lead to new marketing campaigns that may not have previously been thought of. For example, Pick ‘n Pay could run a campaign for ordering groceries online which targets divorced men.

Tech-savvy or Tech laggards: Target Group Index (TGI) established profiles of South Africans who are tech-savvy and those who would be described as tech laggards, not based on their shopping habits but on their attitudes towards technology. This resulted in two groupings; tech trendsetters, those who are very keen on technology and are ready to embrace any new technology, and the laggards, those who aren’t. Statistically, the 4% variance is highly significant.

What this means for you?

Online shopping is very much predicated on an individuals tech-savviness and readiness to embrace technology, even more so for those who aren’t technology orientated. This tells us is that in traditional retail there is no issue around what tools you use when shopping in-store, but there is a clear distinction between those who are ready to use online tools and those that are not. If you have retail stores as well as an e-commerce platform, it is important to separate your target audiences and the ways in which you market to them.

Online retailers in South Africa: the challenges

From a retailers perspective there are two main challenges; ensuring fulfilment isn’t disrupted and accurately forecasting so that there aren’t stock shortages.

These challenges vary depending on sector and category of product being sold, but the electronics sector stood out dramatically, which makes sense looking at the seasonal nature of electronics. The massive buzz around launches for the new iPhone or the new Samsung creates a spike in demand but a month later the buzz disappears and along with it, the demand.

Certain sectors, like arts and crafts, which require a very high level of manual involvement and is a labour intensive business, take time to fulfil orders because every product is being put together almost on demand, and very often the fulfilment fails on the ability to deliver on time.

“It’s incredibly complex to forecast accurately and to be able to fulfil demand accurately,” says Arthur.

There are also external factors that contribute to the very low level of online retail in this country. One of the reasons for the slow online retail growth in South Africa is that we still have a massive mall culture. In fact, we are probably in the top five in the world in terms of malls per capita. The mall is seen by many as a social and entertainment experience.

Another obstacle facing the online retail industry is that retailers are not investing back into the business. The emphasis is on making a profit, rather than creating a long-term sustainable online retail organisation.

In a 2006 interview, Jeff Bezos was asked when Amazon would make a profit, and he responded by saying that it won’t make a profit for at least the next five years, but if they do, they will be in trouble.

“This is the bottom line of online retail success: the future will belong to those who focus on customer centricity. It’s all about the customer, and then along with that, learning from the mistakes of others, transforming weaknesses into strategic strengths, and most importantly, regarding people as more important than products. Those are the retailers that will win in the long run,” Arthur points out.

Online retailers in South Africa: success factors

There are four factors that noticeably stood out and researchers created the golden square of online retail success factors.

- Customer Service

- A wide range of products

- Online user experience

- Customer relations management

“If you want a blueprint for success in online retail, it would be investing in these four elements of the business above everything else,” suggests Arthur.